You can use auctions if you are a real estate investor who wants to purchase a house at a fraction of the original price. Auctions can be risky, and there are many disadvantages to buying a house. It is important to do your research and carefully consider all options.

How does an auction house work?

There are many ways homes can end up at auction. Governments and lenders turn to auctions in order to reduce their losses, recoup some of the costs and sell homes for a fraction of what they are worth.

In tax lien sales, governments often sell properties to individuals and businesses. These are also known to be called foreclosures. They can either be performed by the municipality directly or by a trustee employed by the lender.

The homeowner does not have to pay the mortgage balance or any taxes. The homeowner sells the house to the highest bidder.

A lot of cash is required to buy a house at an auction. You can't inspect it before you buy it. You will need to have an earnest money deposit and you will also need money for the repairs needed on the house.

A home that you buy at auction may not have a clear title. You should do your research to make sure the title is not subject to any liens.

Auction buying is not for everyone. You should be ready to pay a substantial down payment even if your credit rating is good. To cover application fees and closing costs, you may need to have plenty of cash.

There are three types of auction house sales: absolute, fixed and sealed bidding. Absolute auctions are the most popular because they attract the most bidders.

When you're ready to place your bid, you will need to decide whether you're going to bid in person or online. If you're going to bid in person, you will need to make your offer on a specific date and time for the auction.

It is important to understand how the auction works and the deadline for your last bid. You will also need to set a maximum amount that you're willing to bid for the house so that no one else has a chance to outbid you.

There are no guarantees in the auction process that you will get the home you have paid or that the seller won’t cancel their contract. It will be necessary to deal with an auctioneer as well as a seller who may not be financially capable of making the payments.

FAQ

Is it possible to sell a house fast?

It might be possible to sell your house quickly, if your goal is to move out within the next few month. However, there are some things you need to keep in mind before doing so. First, find a buyer for your house and then negotiate a contract. Second, you need to prepare your house for sale. Third, it is important to market your property. Finally, you need to accept offers made to you.

What are the three most important factors when buying a house?

The three main factors in any home purchase are location, price, size. The location refers to the place you would like to live. Price refers the amount that you are willing and able to pay for the property. Size refers the area you need.

What should I look out for in a mortgage broker

A mortgage broker is someone who helps people who are not eligible for traditional loans. They search through lenders to find the right deal for their clients. This service is offered by some brokers at a charge. Others offer free services.

What are the drawbacks of a fixed rate mortgage?

Fixed-rate loans are more expensive than adjustable-rate mortgages because they have higher initial costs. You may also lose a lot if your house is sold before the term ends.

Should I use an mortgage broker?

A mortgage broker may be able to help you get a lower rate. Brokers work with multiple lenders and negotiate deals on your behalf. Some brokers receive a commission from lenders. Before you sign up, be sure to review all fees associated.

Statistics

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

External Links

How To

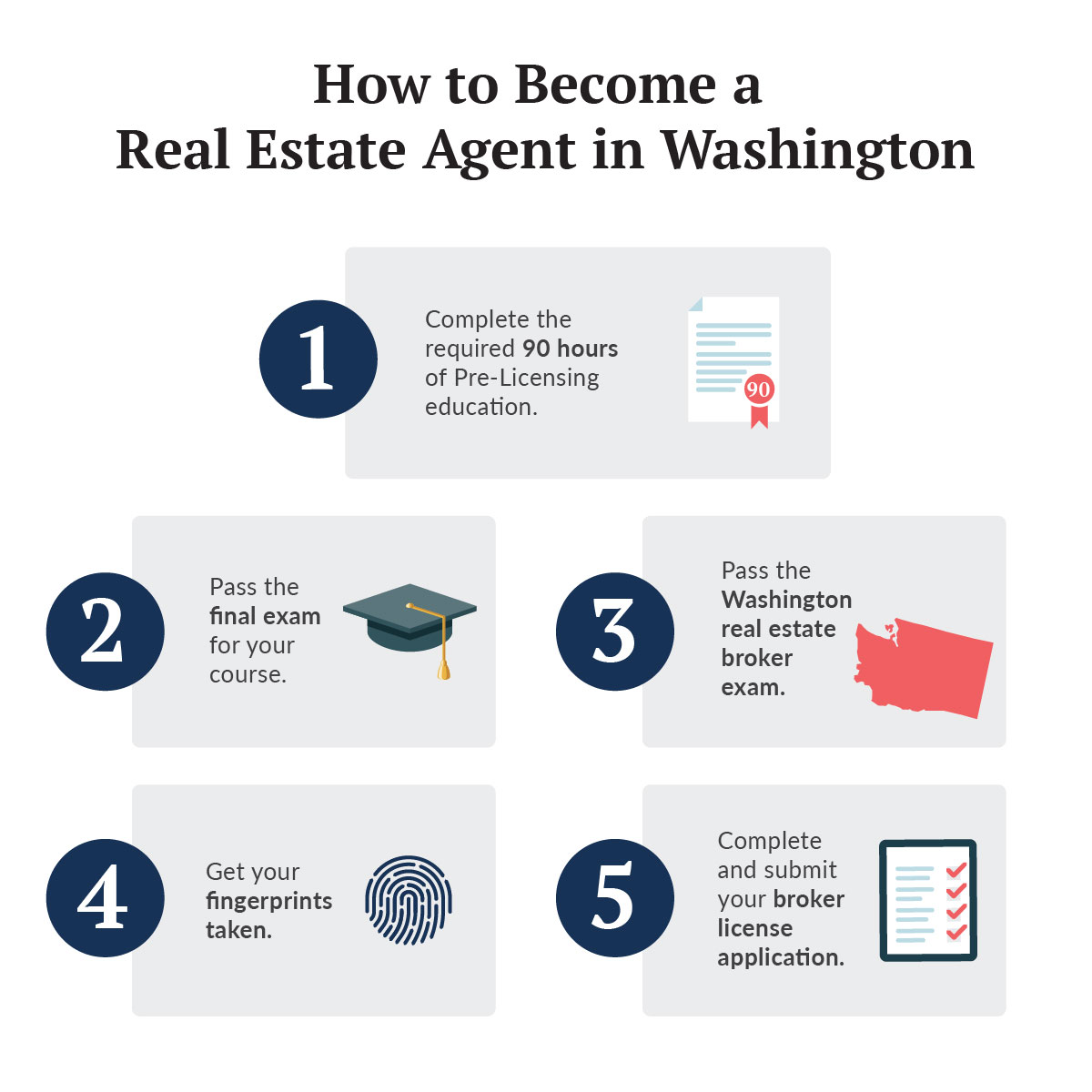

How to become a real estate broker

You must first take an introductory course to become a licensed real estate agent.

Next you must pass a qualifying exam to test your knowledge. This requires you to study for at least two hours per day for a period of three months.

Once this is complete, you are ready to take the final exam. To become a realty agent, you must score at minimum 80%.

These exams are passed and you can now work as an agent in real estate.