There are several ways to earn passive income from real estate. These include renting property, house flipping, REITs and peer-to-peer loans. This article discusses the basics of passive income from real estate. These tips can help you maximize your investment, even if your funds are limited. Continue reading to discover more about passive income through real estate. Only a few steps will get you to your real estate goals.

Let me know if you are interested in renting a property

Renting properties could be a great investment if you are looking to create passive income from realty. Although you should select the right tenants to avoid problems, there are some things that you can do to maximize your income. Not only should you screen prospective tenants thoroughly but also be alert for vacant properties. You may lose money, end up having to go through a lengthy process of eviction, or even be sued if you do not screen potential tenants.

Flipping houses

Passive income from house flipping can come from a variety of sources. Fixer-uppers, foreclosure properties, and rental properties can be flipped to generate income. These properties can be sold as fully renovated and fully rented rentals or as turnkey rental property. The new owners can manage the rental income, and the property is ready to rent. House flipping is a popular and lucrative way to generate passive income. It is easy with the help of technology.

Peer-to-peer lending

There are many passive income investment options when it comes to real estate investments. For example, single-family homes can be more hands-off than apartment buildings. Other than paying the rent, you will also have to manage the property, pay the insurance and monitor the maintenance. A storage facility investment can provide passive income in addition to real estate investments. These properties are in high demand in almost every US region. You can also generate passive income from leasing your space to tenants.

REITs

Passive income from real estate REITs offers a great way to diversify portfolios for the average investor. The unit costs of these securities are very low, at as low as $500. But if you want to receive income from real estate, you must know that these REITs must distribute at least 90 percent of their taxable income to shareholders, leaving less money for reinvestment. We will be looking at passive income from REITs real estate.

Storage facilities

A self-service storage facility can be a passive source of income. Some areas, like Quebec and Canada, have seasonal needs, but there is always a demand for more space. Depending on where the storage facility is located, you may have multiple customers all year. Listed below are some ideas for revenue-generating ideas for storage facilities. Although some of these ideas will require you to put in a lot of effort and time, they will bring you steady income.

FAQ

What are the top three factors in buying a home?

The three main factors in any home purchase are location, price, size. Location refers the area you desire to live. The price refers to the amount you are willing to pay for the property. Size refers to how much space you need.

How do I eliminate termites and other pests?

Termites and many other pests can cause serious damage to your home. They can cause severe damage to wooden structures, such as decks and furniture. You can prevent this by hiring a professional pest control company that will inspect your home on a regular basis.

Can I afford a downpayment to buy a house?

Yes! Yes. There are programs that will allow those with small cash reserves to purchase a home. These programs include government-backed mortgages (FHA), VA loans and USDA loans. For more information, visit our website.

Is it possible to get a second mortgage?

Yes, but it's advisable to consult a professional when deciding whether or not to obtain one. A second mortgage is often used to consolidate existing loans or to finance home improvement projects.

What can I do to fix my roof?

Roofs may leak from improper maintenance, age, and weather. Minor repairs and replacements can be done by roofing contractors. Get in touch with us to learn more.

Should I use a broker to help me with my mortgage?

Consider a mortgage broker if you want to get a better rate. Brokers work with multiple lenders and negotiate deals on your behalf. However, some brokers take a commission from the lenders. Before signing up for any broker, it is important to verify the fees.

Should I rent or purchase a condo?

Renting could be a good choice if you intend to rent your condo for a shorter period. Renting will allow you to avoid the monthly maintenance fees and other charges. On the other hand, buying a condo gives you ownership rights to the unit. You can use the space as you see fit.

Statistics

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

External Links

How To

How to become an agent in real estate

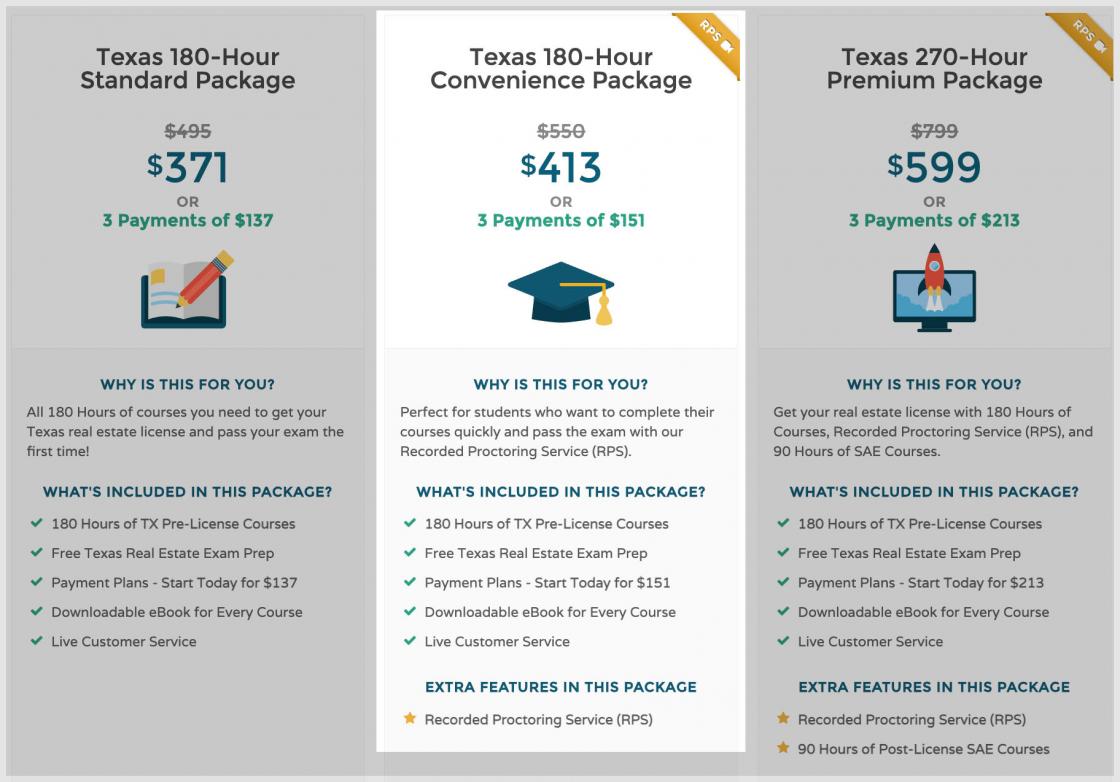

Attending an introductory course is the first step to becoming a real-estate agent.

Next, pass a qualifying test that will assess your knowledge of the subject. This requires you to study for at least two hours per day for a period of three months.

Once you have passed the initial exam, you will be ready for the final. For you to be eligible as a real-estate agent, you need to score at least 80 percent.

If you pass all these exams, then you are now qualified to start working as a real estate agent!