What can a real estate license do for you?

If you have ever wanted to become an agent in real estate, there are many benefits to getting your own license. You can make a lot of money by getting your own license and it can help you build your career. However, it is important to understand that it does require some upfront monetary and time investments. Consider the cost for classes, broker fees, and marketing expenses to get your real property license.

Why you need a license to sell real estate?

A real estate license can be pursued for many reasons. A real estate license will allow you to be more profitable as an investor and also give you a higher education and skill.

In addition to generating additional revenue, a real estate license can also help you build a reputation within the industry that can help you stand out among your peers. It allows you to network with other members of the business, which can make it easier for your to close deals.

A realty license permits you to buy or rent property in the jurisdiction where you are licensed. To become licensed in your state, you will typically need to pass an exam. The requirements for licensure in your state may vary depending on where you live.

The process of getting a license can take anywhere form a few days up to several months, depending upon the state where you live. You will need to pass the state exam and complete the pre-license education requirements. Online courses are available in some states. This will allow you to finish the requirements quicker.

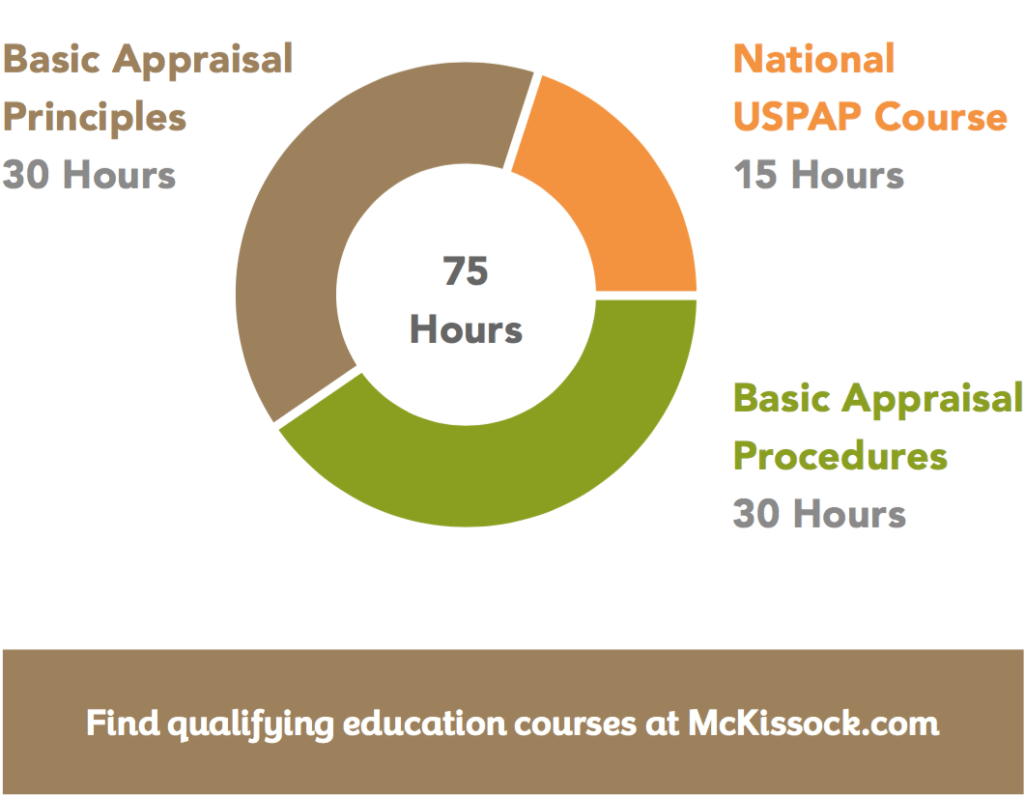

For licensure in your state, you must complete at least 75 hours worth of real estate education. You can also go to an accredited college or learn online. You will have a greater chance of passing the real estate exam first time because most online courses are self-paced, and include study materials such as flashcards and practice tests.

Some schools offer a guarantee of passing the exam on your first attempt. This is a great opportunity to boost your confidence, and get you started in a successful real-estate career.

Building a Professional Network

A real estate license is often the first step to a new and successful career in real estate. Your license will allow you to connect with investors, real estate agents, and clients in your region. This can open up new opportunities and lead to bigger and more lucrative deals.

Being a licensed real agent means you have access to the MLS (the actual estate listing database). This can be an enormous asset for investors looking for the best possible properties at the cheapest prices.

FAQ

How many times do I have to refinance my loan?

This depends on whether you are refinancing with another lender or using a mortgage broker. You can typically refinance once every five year in either case.

Should I rent or own a condo?

Renting could be a good choice if you intend to rent your condo for a shorter period. Renting can help you avoid monthly maintenance fees. On the other hand, buying a condo gives you ownership rights to the unit. You have the freedom to use the space however you like.

What are the key factors to consider when you invest in real estate?

First, ensure that you have enough cash to invest in real property. You will need to borrow money from a bank if you don’t have enough cash. You also need to ensure you are not going into debt because you cannot afford to pay back what you owe if you default on the loan.

You must also be clear about how much you have to spend on your investment property each monthly. This amount must cover all expenses related to owning the property, including mortgage payments, taxes, insurance, and maintenance costs.

Finally, you must ensure that the area where you want to buy an investment property is safe. It is best to live elsewhere while you look at properties.

Should I use an mortgage broker?

Consider a mortgage broker if you want to get a better rate. Brokers can negotiate deals for you with multiple lenders. Some brokers do take a commission from lenders. You should check out all the fees associated with a particular broker before signing up.

Statistics

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

External Links

How To

How to become a real estate broker

Attending an introductory course is the first step to becoming a real-estate agent.

Next, you will need to pass a qualifying exam which tests your knowledge about the subject. This means that you will need to study at least 2 hours per week for 3 months.

You are now ready to take your final exam. You must score at least 80% in order to qualify as a real estate agent.

All these exams must be passed before you can become a licensed real estate agent.