Rent to Own

A rent to own agreement can be a great way to purchase a home without paying too much. This type agreement can help you build equity. There are risks to renting to own, so you need to do your homework before signing one. Do your research on the seller, home, and contract.

Hard money loans

You can use a loan to raise the funds you need for real estate investments. These loans allow you to purchase property without any money up front, and they usually cover the construction and acquisition costs. Even though they are very expensive, these loans can be fast to access funds. You can close your loan within a few days, and begin working on your investment property.

House hacking

House hacking is a great strategy if you don't have enough money to buy property. This strategy allows you to purchase a house with very little or no down payment and then use the down payment savings to cover other expenses. This strategy doesn't require equity building and is perfect for first-time home buyers.

Use other people's money

The best way to invest in real estate is to use the money of others. This is a great way reduce risk and increase your returns. You need to be savvy with how you use other people’s money.

Investing via REITs

REITs allow you to invest in real estate with little capital. They allow you to diversify your portfolio by owning a variety of different types of properties. They also give you the benefit of dividends and passive income. With the right REIT you can invest as little $100. You can also set-up automatic investing or dollar-cost averaging.

Crowdfunding

If you have no money but still want to invest in real estate, crowdfunding can be a great option. Real estate crowdfunding platforms enable you to pool your funds with other investors to make investment. Real estate investment trusts (REITs) are one type of such investments. They own multiple income-generating real properties. These investments are a more straightforward way to build wealth with a smaller amount of money than many other investment methods. REITs can be either publicly traded or privately traded. You can earn higher dividends with REITs that are publicly traded than in many stocks.

FAQ

How do I fix my roof

Roofs may leak from improper maintenance, age, and weather. Minor repairs and replacements can be done by roofing contractors. Get in touch with us to learn more.

Should I buy or rent a condo in the city?

If you plan to stay in your condo for only a short period of time, renting might be a good option. Renting lets you save on maintenance fees as well as other monthly fees. A condo purchase gives you full ownership of the unit. You are free to make use of the space as you wish.

How do I calculate my interest rate?

Market conditions impact the rates of interest. The average interest rates for the last week were 4.39%. To calculate your interest rate, multiply the number of years you will be financing by the interest rate. For example, if $200,000 is borrowed over 20 years at 5%/year, the interest rate will be 0.05x20 1%. That's ten basis points.

How much does it cost to replace windows?

Window replacement costs range from $1,500 to $3,000 per window. The exact size, style, brand, and cost of all windows replacement will vary depending on what you choose.

Statistics

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

External Links

How To

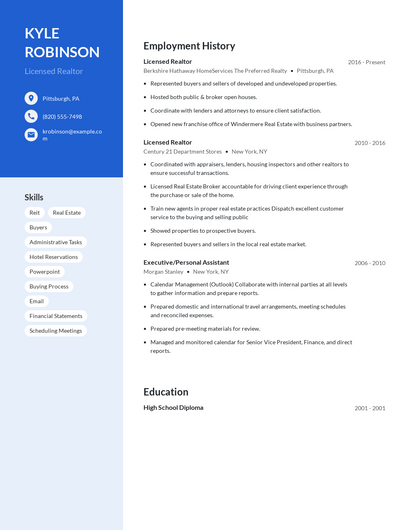

How to Locate Real Estate Agents

Agents play an important role in the real-estate market. They help people find homes, manage their properties and provide legal advice. You will find the best real estate agents with experience, knowledge and communication skills. Look online reviews to find qualified professionals and ask family members for recommendations. You may also want to consider hiring a local realtor who specializes in your specific needs.

Realtors work with both buyers and sellers of residential real estate. The job of a realtor is to assist clients in buying or selling their homes. Apart from helping clients find the perfect house to call their own, realtors help manage inspections, negotiate contracts and coordinate closing costs. A commission fee is usually charged by realtors based on the selling price of the property. Unless the transaction is completed, however some realtors may not charge any fees.

The National Association of REALTORS(r) (NAR) offers several different types of realtors. To become a member of NAR, licensed realtors must pass a test. A course must be completed and a test taken to become certified realtors. Accredited realtors are professionals who meet certain standards set by NAR.