Real Estate Complaints

A complaint may be filed if you feel that your broker or agent has cheated you. Your state has a process for filing complaints against agents and brokers that is fairly simple to follow. This involves providing details and supporting evidence to the agency which will investigate the complaint.

First, gather all documents you believe to be evidence of the alleged wrongdoing. Then, submit them to the state agency along with a detailed explanation about how you feel the broker or real estate agent acted. This could include the contract of sale, inspection reports, and any other documents that prove what you believe happened during the transaction.

Next, take down the details of all the events leading up to your complaint. This will help you to remember the timeline and ensure that everything is clear. If you ever need to show evidence of the alleged wrongdoing, it will help you.

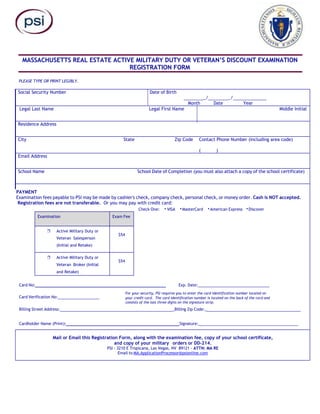

Although forms can vary from one state or another, most will be available online. Please fill in your contact information as well as the name and postal address of the broker. Also, provide details about what you believe happened during that sale. Some forms will require you to show proof of receipts that the broker or realtor provided for estimates or other services.

Your state has its own realty commission, which handles complaints concerning real estate licensees. The complaint will be investigated by the commission and a decision made about what to do.

This investigation can take many months depending on the complexity and the number involved. The state will then gather additional documents to support your claims against the broker and real estate agent.

You must adhere to the Code of Ethics if you are a member of National Association of Realtors. If you do not belong to the Association, your recourse would be to the state realty authorities or the courts.

After you have gathered enough evidence, you must decide whether it is worth filing an official complaint. Discuss the benefits and risks of this option with an attorney. The most important thing you can do is determine how serious your situation is and the best course.

You should also consider the statute of limitations in your state. Although the time it takes to file a claim varies from one state to another, it generally ranges between five to four years. This ensures that your case can be brought back if it has not been resolved.

You should also consider contacting the board of realtors in your area to see if they have an ethics committee. These committees are typically made up of members of your local real estate association and are tasked with investigating complaints against real estate agents in their area. The complaint will be reviewed by the board of realtors who will determine if it violates their Code of Ethics. They will then investigate the matter and issue warnings or suspend licenses to real estate agents if they find it violates their Code of Ethics.

FAQ

What is a Reverse Mortgage?

Reverse mortgages allow you to borrow money without having to place any equity in your property. It allows you access to your home equity and allow you to live there while drawing down money. There are two types: government-insured and conventional. You must repay the amount borrowed and pay an origination fee for a conventional reverse loan. FHA insurance covers your repayments.

Can I get a second mortgage?

Yes, but it's advisable to consult a professional when deciding whether or not to obtain one. A second mortgage is often used to consolidate existing loans or to finance home improvement projects.

How can I fix my roof

Roofs may leak from improper maintenance, age, and weather. Roofing contractors can help with minor repairs and replacements. Contact us to find out more.

Should I rent or own a condo?

Renting is a great option if you are only planning to live in your condo for a short time. Renting allows you to avoid paying maintenance fees and other monthly charges. However, purchasing a condo grants you ownership rights to the unit. The space can be used as you wish.

Which is better, to rent or buy?

Renting is generally less expensive than buying a home. It's important to remember that you will need to cover additional costs such as utilities, repairs, maintenance, and insurance. Buying a home has its advantages too. For instance, you will have more control over your living situation.

Statistics

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

External Links

How To

How to Manage A Rental Property

Although renting your home is a great way of making extra money, there are many things you should consider before you make a decision. We'll show you what to consider when deciding whether to rent your home and give you tips on managing a rental property.

If you're considering renting out your home, here's everything you need to know to start.

-

What is the first thing I should do? You need to assess your finances before renting out your home. If you are in debt, such as mortgage or credit card payments, it may be difficult to pay another person to live in your home while on vacation. Your budget should be reviewed - you may not have enough money to cover your monthly expenses like rent, utilities, insurance, and so on. It may not be worth it.

-

How much does it cost to rent my home? There are many factors that go into the calculation of how much you can charge to let your home. These factors include your location, the size of your home, its condition, and the season. Remember that prices can vary depending on where your live so you shouldn't expect to receive the same rate anywhere. Rightmove estimates that the market average for renting a 1-bedroom flat in London costs around PS1,400 per monthly. This would translate into a total of PS2,800 per calendar year if you rented your entire home. It's not bad but if your property is only let out part-time, it could be significantly lower.

-

Is it worth it? Doing something new always comes with risks, but if it brings in extra income, why wouldn't you try it? Make sure that you fully understand the terms of any contract before you sign it. You will need to pay maintenance costs, make repairs, and maintain the home. Renting your house is not just about spending more time with your family. You should make sure that you have thoroughly considered all aspects before you sign on!

-

Is there any benefit? Now that you have an idea of the cost to rent your home, and are confident it is worth it, it is time to consider the benefits. You have many options to rent your house: you can pay off debt, invest in vacations, save for rainy days, or simply relax from the hustle and bustle of your daily life. You will likely find it more enjoyable than working every day. If you plan ahead, rent could be your full-time job.

-

How can I find tenants Once you've decided that you want to rent out, you'll need to advertise your property properly. Online listing sites such as Rightmove, Zoopla, and Zoopla are good options. Once you receive contact from potential tenants, it's time to set up an interview. This will enable you to evaluate their suitability and verify that they are financially stable enough for you to rent your home.

-

What can I do to make sure my home is protected? If you fear that your home will be left empty, you need to ensure your home is protected against theft, damage, or fire. Your landlord will require you to insure your house. You can also do this directly with an insurance company. Your landlord will likely require you to add them on as additional insured. This is to ensure that your property is covered for any damages you cause. This doesn't apply to if you live abroad or if the landlord isn’t registered with UK insurances. In such cases you will need a registration with an international insurance.

-

Sometimes it can feel as though you don’t have the money to spend all day looking at tenants, especially if there are no other jobs. Your property should be advertised with professionalism. A professional-looking website is essential. You can also post ads online in local newspapers or magazines. A complete application form will be required and references must be provided. While some people prefer to handle everything themselves, others hire agents who can take care of most of the legwork. It doesn't matter what you do, you will need to be ready for questions during interviews.

-

What happens after I find my tenant?After you've found a suitable tenant, you'll need to agree on terms. If you have a lease in place, you'll need to inform your tenant of changes, such as moving dates. If you don't have a lease, you can negotiate length of stay, deposit, or other details. Keep in mind that you will still be responsible for paying utilities and other costs once your tenancy ends.

-

How do I collect my rent? When it comes to collecting the rent, you will need to confirm that the tenant has made their payments. You'll need remind them about their obligations if they have not. You can subtract any outstanding rent payments before sending them a final check. If you're struggling to get hold of your tenant, you can always call the police. They will not usually evict someone unless they have a breached the contract. But, they can issue a warrant if necessary.

-

How can I avoid problems? Renting out your house can make you a lot of money, but it's also important to stay safe. Install smoke alarms, carbon monoxide detectors, and security cameras. Also, make sure you check with your neighbors to see if they allow you to leave your home unlocked at night. You also need adequate insurance. You must also make sure that strangers are not allowed to enter your house, even when they claim they're moving in the next door.