Your GI Bill can be used to pay your real estate license if your are a former military member. Your GI Bill can pay for certification tests and the course. You can find more information at the Department of Veterans Affairs. Contact the Department of Veterans Affairs to learn more about reimbursement.

For military veterans, who are not currently in service, there are several options to get a license. First, scholarships can be available to cover some of the costs. You may be eligible for up to $1,000 depending on which program you are applying. These scholarships are not available for classroom-based courses.

An alternative option to obtaining your license is to take an online pre-license course. AceableAgent offers a variety of courses for people interested in obtaining a real estate license. These courses are inexpensive and include all necessary training. However, additional costs for obtaining your license as a real estate agent will be charged to you.

Many national brokerages are now offering programs to help recruit veterans. For example, the Northern Virginia Association of Realtors has a program to help transitioning service members get started in the industry. Interested veterans can submit a certificate proving that they are eligible and a DD214.

If you are not already a licensed real estate agent, you can take a pre-license course at Florida Real Estate University. The university offers a 63-hour sales associate pre-licensing class. The VA will reimburse any fees you pay. This will allow for you to launch your real-estate career in just weeks.

Operation RE/MAX may also be a program that will help you. Operation RE/MAX matches veterans and their spouses with mentors to help them in the journey of becoming licensed real estate professionals. They will then commit to 24-months to the BHGRE metro Brokers' Xcelerater program. After passing their real estate exam, they are eligible to begin work.

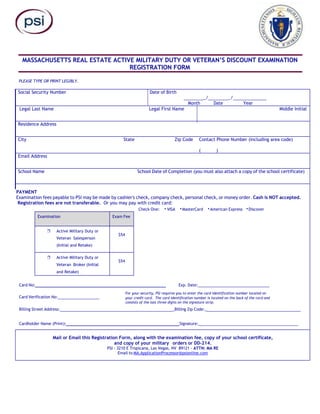

A waiver can be requested by active-duty personnel for the initial licensing cost. This can be done online and by mailing an application to assessor. You should note that a waiver will not be granted for renewals of your license and criminal background checks.

The Texas Real Estate Commission has several benefits for military service members. This includes an expedited application process. You may be eligible if you're a military member and hold a current state license.

Veterans to REP can be used by both active and retired military personnel. For military spouses, there are additional benefits. These programs provide post licensing support and training.

A third option is to find out if you are eligible for reimbursement of your license and certification costs by contacting the Department of Veterans Affairs. The VA website lists approved opportunities for real estate license reimbursement.

FAQ

What should I do before I purchase a house in my area?

It depends on how much time you intend to stay there. Start saving now if your goal is to remain there for at least five more years. If you plan to move in two years, you don't need to worry as much.

What are some of the disadvantages of a fixed mortgage rate?

Fixed-rate loans tend to carry higher initial costs than adjustable-rate mortgages. If you decide to sell your house before the term ends, the difference between the sale price of your home and the outstanding balance could result in a significant loss.

How can I get rid Termites & Other Pests?

Over time, termites and other pests can take over your home. They can cause serious damage to wood structures like decks or furniture. A professional pest control company should be hired to inspect your house regularly to prevent this.

Statistics

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

External Links

How To

How to locate an apartment

When moving to a new area, the first step is finding an apartment. This involves planning and research. This involves researching and planning for the best neighborhood. This can be done in many ways, but some are more straightforward than others. Before you rent an apartment, consider these steps.

-

It is possible to gather data offline and online when researching neighborhoods. Online resources include Yelp. Zillow. Trulia. Realtor.com. Local newspapers, real estate agents and landlords are all offline sources.

-

You can read reviews about the neighborhood you'd like to live. Yelp. TripAdvisor. Amazon.com have detailed reviews about houses and apartments. You might also be able to read local newspaper articles or visit your local library.

-

You can make phone calls to obtain more information and speak to residents who have lived there. Ask them what they liked and didn't like about the place. Also, ask if anyone has any recommendations for good places to live.

-

Check out the rent prices for the areas that interest you. Renting somewhere less expensive is a good option if you expect to spend most of your money eating out. On the other hand, if you plan on spending a lot of money on entertainment, consider living in a more expensive location.

-

Find out about the apartment complex you'd like to move in. For example, how big is it? What price is it? Is it pet-friendly? What amenities does it offer? Do you need parking, or can you park nearby? Are there any rules for tenants?