Find a sponsoring agent if you are looking to get your Virginia real-estate license. A broker will help you get the education and experience that you need to be a successful real-estate agent in the state. A broker will also help build your industry reputation and promote your business.

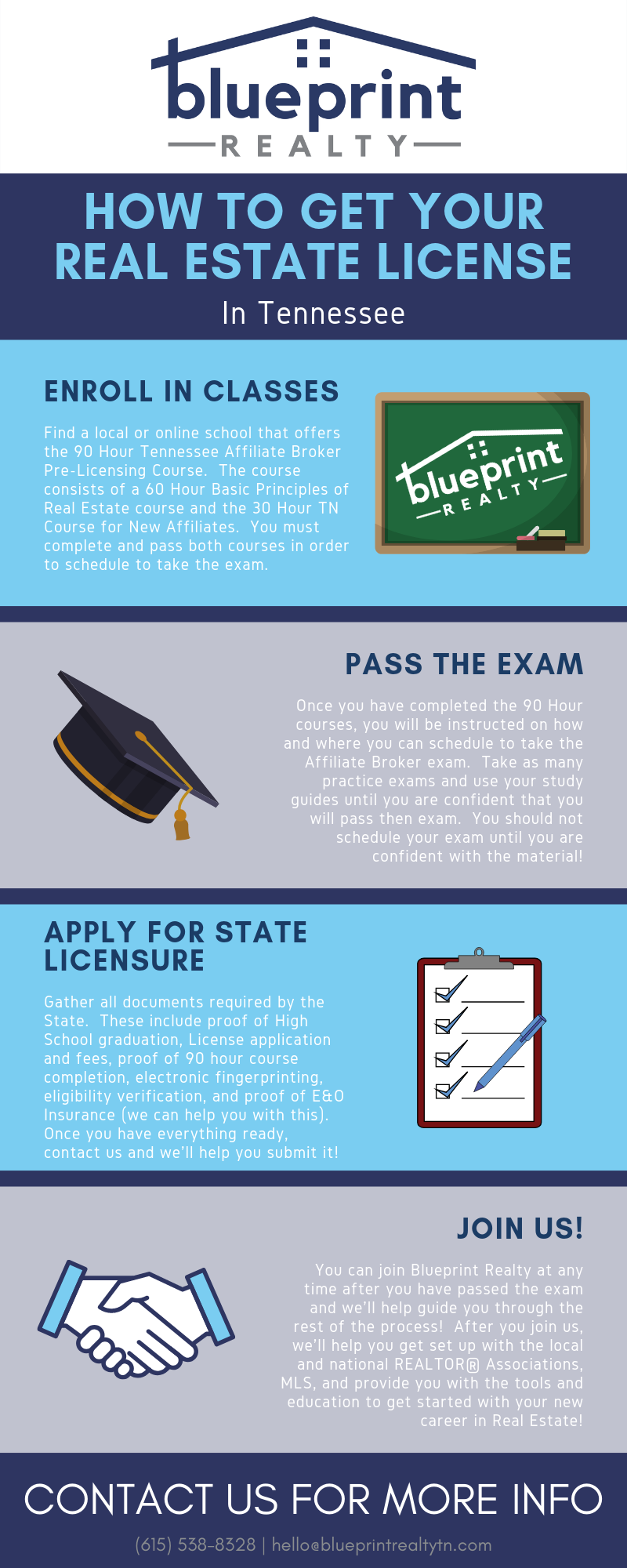

To apply for a Virginia real estate license you must also meet the educational requirements. You will need to complete a 60-hour course at an approved school before you can apply for your Virginia real estate license.

Virginia's real property licensing process is pretty similar to other states. It does however have some distinctive aspects that will make it a little different.

1. The Real Estate Board requires all applicants to disclose any past criminal convictions on their application for licensure. The Real Estate Board reviews these convictions and will make a determination based upon your explanation.

2. A record containing felony convictions and/or judgments could result in licensure being denied.

3. You should have a good reputation for honesty, truthfulness, and fair dealing in order to qualify for a real estate license.

4. Good work ethics and the willingness to learn from mistakes are important.

5. You should be able to handle a busy schedule.

6. A good marketing strategy is essential to help you market your services effectively to potential clients.

7. You must have a solid understanding of the local market as well as the intricacies involved with real estate sales.

8. Negotiating effectively with clients and managing transactions should be your forte.

9. You need to be familiar with the mortgage system and able to handle different types of loans such as FHA, VA and conventional.

10. It is important that you are able to both sell residential and commercial property.

You might find it difficult to navigate the industry if you are just starting out. Good news is that your career path can be based on what interests you the most.

Another option is to specialize in one area. There are many popular areas in real estate that offer career growth.

1. As a salesperson, you can make more than a broker.

Real estate salespersons in Virginia can make around $40,000 to $45,000 per year. Although it's not the most lucrative career in Virginia, this is a great choice for people who want to help people sell and buy homes.

2. Virginia is open to both residential and business property sales.

Your Virginia real estate license is a significant milestone in your career that can open many doors for you. No matter whether you're a beginner or a veteran professional, it is crucial to understand the industry thoroughly and be prepared to face any challenge.

FAQ

What are the advantages of a fixed rate mortgage?

Fixed-rate mortgages guarantee that the interest rate will remain the same for the duration of the loan. This will ensure that there are no rising interest rates. Fixed-rate loans have lower monthly payments, because they are locked in for a specific term.

What should I do if I want to use a mortgage broker

If you are looking for a competitive rate, consider using a mortgage broker. Brokers work with multiple lenders and negotiate deals on your behalf. Some brokers do take a commission from lenders. Before signing up, you should verify all fees associated with the broker.

Is it possible to quickly sell a house?

It might be possible to sell your house quickly, if your goal is to move out within the next few month. There are some things to remember before you do this. First, you must find a buyer and make a contract. You must prepare your home for sale. Third, advertise your property. You must also accept any offers that are made to you.

How long does it take to get a mortgage approved?

It depends on many factors like credit score, income, type of loan, etc. It typically takes 30 days for a mortgage to be approved.

What are the drawbacks of a fixed rate mortgage?

Fixed-rate mortgages tend to have higher initial costs than adjustable rate mortgages. A steep loss could also occur if you sell your home before the term ends due to the difference in the sale price and outstanding balance.

How much money should I save before buying a house?

It all depends on how many years you plan to remain there. If you want to stay for at least five years, you must start saving now. If you plan to move in two years, you don't need to worry as much.

What are the three most important things to consider when purchasing a house

The three most important things when buying any kind of home are size, price, or location. Location refers the area you desire to live. Price refers the amount that you are willing and able to pay for the property. Size is the amount of space you require.

Statistics

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

External Links

How To

How to become a broker of real estate

You must first take an introductory course to become a licensed real estate agent.

The next step is to pass a qualifying examination that tests your knowledge. This requires you to study for at least two hours per day for a period of three months.

Once this is complete, you are ready to take the final exam. To be a licensed real estate agent, you must achieve a minimum score of 80%.

These exams are passed and you can now work as an agent in real estate.